Home > Accounting > Guide to Securing a Tax Clearance Certificate in the UAE

Guide to Securing a Tax Clearance Certificate in the UAE

May 12, 2024 | Accounting

Understanding the Tax Clearance Certificate in the UAE

A Tax Clearance Certificate in the United Arab Emirates (UAE) serves as proof that an individual or business has met all their tax obligations. This certificate is essential for various business transactions and is a key indicator of adherence to the country’s tax regulations. As the UAE’s economic landscape evolves, knowing how to obtain this certificate is vital for both businesses and individuals.

In this guide, we will cover:

- Eligibility Criteria: Who qualifies for a Tax Clearance Certificate.

- Application Process: Step-by-step instructions on how to apply.

- Strategic Importance: Why having a Tax Clearance Certificate is beneficial.

Whether you’re a business owner, a tax consultant, or someone aiming to maintain a clean financial record, we will provide you with the necessary steps and expert tips to navigate the tax compliance requirements effectively.

Understanding the Tax Clearance Certificate in the UAE

What is a Tax Clearance Certificate?

In the UAE, a Tax Clearance Certificate is a crucial document that verifies whether a tax-registered entity has settled all its tax liabilities or is not subject to any outstanding tax payments. Issued by the Federal Tax Authority (FTA), this certificate is a testament to the entity’s adherence to its tax obligations. The FTA has streamlined the process by integrating a feature in the taxpayer’s online portal, allowing for easy requests of the “CLEARANCE CERTIFICATE.”

Importance and Uses of the Certificate

The Tax Clearance Certificate serves as proof of tax compliance and plays a significant role in various business-related processes. It is essential in scenarios such as mergers and acquisitions, business cessation, ownership transfers, securing bank facilities, and visa issuance. Having this certificate demonstrates an entity’s commitment to fulfilling its fiscal responsibilities and helps in avoiding penalties associated with non-compliance.

Entities undergoing acquisition, winding up, or VAT deregistration will find this certificate particularly important. It ensures that the business is in good standing with the tax authorities and maintains its reputation as a compliant entity.

Legal Basis for Tax Clearance in the UAE

The FTA’s implementation of the tax clearance certificate is a strategic measure to enhance compliance with UAE tax laws. To obtain this certificate, an entity must have a clean record with the FTA, with no outstanding tax liabilities. Failure to secure a tax clearance certificate can impede various business activities.

Applying for this certificate may trigger a tax audit, which is a routine process for tax-registered entities. Non-registrants must demonstrate to the FTA that they are not required to register for tax. This legal framework helps ensure that all entities meet their tax obligations, contributing to a transparent and regulated business environment in the UAE.

Eligibility Criteria for Tax Residency Certificates (TRC) and Certificate of Application for Clearance (CAC)

Eligibility for Individuals

To be eligible for a Tax Residency Certificate (TRC), individuals must meet the following criteria:

- Residency Requirement: Must have resided in the UAE for at least 183 days within the financial year of application. This residency period is crucial for determining eligibility.

- Non-Residents: Foreign and offshore company branches are not considered residents and therefore are not eligible for a TRC.

Eligibility for Corporate Entities

Legal entities must fulfill these conditions to apply for a TRC or CAC:

- Establishment: The entity must have been established in the UAE for over one year prior to application, demonstrating a substantial presence in the country.

- VAT Registration: Entities must be VAT-registered in the UAE to apply for a CAC. The CAC verifies the entity’s commercial activities within the UAE.

Special Considerations for Non-Residents

Non-residents must provide comprehensive evidence of their economic and physical presence in the UAE to qualify for tax certificates. Required documentation includes proof of physical presence and financial interests in the UAE. Non-residents should meticulously document their stays and financial engagements to meet the FTA’s stringent requirements.

Required Documentation for Initial Assessment

For Individuals:

- Passport

- Residence permit

- Emirates ID

- Residential lease agreement

- Proof of income

- Bank statements

- Entry and exit report

- Evidence of permanent residence in the UAE

For Legal Entities:

- Trade license

- Memorandum of association

- Authorization proof

- Audited financial statements

- Bank statements

For Government Entities:

- Copy of the decree or government decision

- Trade license

- Request letter from the entity

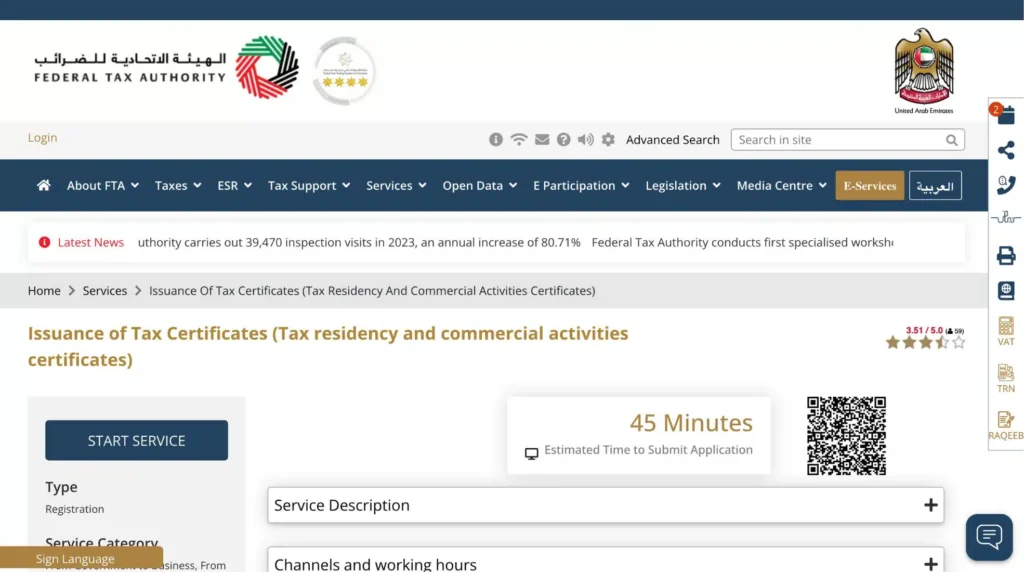

Application Process

Applications for TRCs and CACs can be made through the EMARATAX portal, which is available 24/7. The application process is streamlined with an average submission time of 45 minutes and a processing time of 5 business days once a complete application is received.

Validity and Fees:

- TRC: Valid for one year from the start of the financial year.

- CAC: Valid for one year from the selected date.

- Submission Fee: $13.60 (AED 50) for treaty purposes.

- CAC Fee: $136 (AED 500). Additional fee of $68 (AED 250) per physical copy.

Certificates are sent electronically to the applicant’s email after payment. If a printed certificate is required, it will be delivered within the UAE only. Special forms for TRCs can be submitted electronically or via mail or courier for FTA attestation. Exit & Entry reports are obtainable through the UAEICP application.

Application Process for Tax Clearance Certificate

Application Guide

Access the EmaraTax Platform:

- Log in to the EmaraTax portal using your credentials or UAE Pass.

- Navigate to the ‘Other Services’ section and select ‘Clearance Certificate.’

Start a New Request:

- Click on ‘New Request’ to initiate the application process.

- Complete the application form with your business details, including trade licence information in both English and Arabic.

- Specify the reason for the certificate request, such as changes in ownership or business closure.

Upload Required Documents:

- Attach necessary documents, which may include financial statements and a declaration letter.

- Depending on your situation, additional documents like a sale contract or proof of business cessation might be required.

- Ensure all financial figures are presented in AED.

Review and Submit:

- Review the completed application and documents.

- Submit the application along with the filled-in declaration form.

Online vs. Offline Submission Options

- Online Submission: The EmaraTax platform facilitates a paperless application process. Ensure you have digital copies of all required documents for a smooth online submission.

- Offline Submission: Although online submission is preferred, if needed, documents can be submitted via mail or courier, but this may lead to longer processing times.

Payment of Fees and Dues

- Fee Structure: The fees for obtaining a certificate vary based on the type of certificate and your tax status. For instance, a Tax Residency Certificate (TRC) involves a submission fee, with additional charges applicable based on your registration status and whether you are an individual or a legal entity.

- Printed Certificates: An extra fee applies for each physical copy of the certificate if requested. Verify the current rates before applying, as fees may change.

Expected Timeframe for Processing

- Review Time: The Federal Tax Authority (FTA) typically reviews applications within five business days.

- Printed Certificates: If you request a printed certificate, anticipate a similar processing time following payment.

- Tax Form Attestation: For applications including a tax form requiring FTA attestation, the processing period is five working days from the receipt of the completed form and payment.

Tracking Your Application

- Status Updates: Track your application’s status through the EmaraTax dashboard.

- Reference Number: Upon successful submission, you will receive a reference number for tracking.

- Notifications: If additional information is required or if the application is rejected, you will be notified via email. You may need to provide further details or submit a new request.

Ensure that your tax records are up-to-date before applying to avoid potential audits or liabilities. If you need assistance during the process, the EmaraTax support team is available to help.

Expert Tips for Managing Your Tax Clearance Certificate

Should You Hire a Professional?

Navigating the UAE’s tax system can be complex, and enlisting the help of a tax consultant can be highly beneficial. For individuals or businesses with diverse revenue streams or international operations, a tax consultant offers strategic planning and asset protection, potentially leading to significant long-term financial benefits.

Advantages of a Tax Consultant:

- Tax Burden Reduction: Consultants can identify strategies to minimize tax liabilities, allowing more capital for reinvestment or other priorities.

- Compliance and Strategic Advice: A skilled consultant ensures accurate filings and provides guidance to optimize your tax strategy.

- Proven Track Record: Choose a consultant with a history of successful client outcomes, transparency, and a commitment to confidentiality and ethical standards.

Maintaining Compliance Post-Issuance

After receiving your tax clearance certificate, it is crucial to stay compliant with tax obligations. Tax consultants play a key role in:

- Monitoring Updates: Keeping track of changes in tax regulations.

- Reviewing Submissions: Scrutinizing past tax filings to ensure ongoing compliance.

- Avoiding Sanctions: Preventing penalties due to missed deadlines or errors in submissions.

Impact of a Tax Clearance Certificate on Future Filings

Holding a tax clearance certificate demonstrates a history of compliance and can positively affect future tax filings. This is especially useful during audits or business transactions that require proof of tax adherence.

Key Contacts and Helpful Resources

The UAE offers a range of tax professionals and firms specializing in various aspects of tax management:

- Certified Accountants: For individual and business tax needs.

- Specialized Tax Consultancies: Focused on VAT, corporate, and international tax issues.

- Legal and Accounting Firms: Offering comprehensive tax planning and compliance services.

For specific needs, organizations like Virtuzone provide expert advice on corporate tax compliance and obtaining tax clearance certificates. Tax professionals are essential for:

- VAT and Corporate Tax Registration/De-registration

- Return Submissions and Refund Processing

- Maintaining Ongoing Tax Compliance

- Navigating Transnational Tax Laws

Final Takeaway

Obtaining a Tax Clearance Certificate is more than a procedural step; it reflects your commitment to financial health and regulatory adherence. With the evolving fiscal landscape in the UAE, especially with new corporate tax regulations, the certificate reinforces your business’s integrity and supports smoother financial operations.

Although the EmaraTax portal simplifies the application process, the expertise of tax professionals can enhance the accuracy and effectiveness of your submission. Proactive tax management post-certification is crucial for ongoing compliance, contributing to a stable and reputable business environment.